The basics of portfolio management: How can you optimise your returns and limit your risks?

So, you've decided to build an investment portfolio, but you don't really know where to start? In this article, we look at the basics of portfolio optimisation.

Portfolio management: a definition

Portfolio management is the science of selecting, then monitoring and adjusting, as necessary, a portfolio of investments, the combination of which is designed to achieve an optimal risk/return trade-off.

Building your portfolio: the importance of diversification

An investment portfolio should generate a return on your assets that is adjusted to the risk you are prepared to assume. Some financial instruments offer higher potential returns, but their volatility makes them riskier. Others offer greater stability but lower returns.

An investment portfolio can be made up of many different types of financial securities. For the sake of simplicity, here are the three main asset classes we will use for our example:

- Cash: offers little or no return but can be used to enable you to sieze investment opportunities more easily or to facilitate adjustments.

- Bonds: offer a low but reliable return and are one of the least risky investments.

- Shares: With greater fluctuations, they offer higher potential gains with greater volatility.

A good investment portfolio is based on an appropriate asset allocation between equities, bonds and cash. At Piguet Galland, as at other financial institutions, asset allocation can sometimes be supplemented by other instruments such as real estate funds, alternative investments or commodities notably precious metals. The aim is to benefit from the potential gains of certain instruments while minimising the overall risk of the portfolio with other securities that are safer and offer greater visibility.

Within these categories, you need to diversify your choices and achieve different levels of granularity. In the case of equities, for example, you may need to split your allocation between large-cap, mid-cap, and small-cap companies, or invest in different business sectors.

Some examples of standard portfolios

To give you a clearer idea of the different ways you can build an investment portfolio, here are three standard examples: a conservative portfolio, a dynamic portfolio and a balanced portfolio.

- Conservative portfolio: (60% bonds, 35% equities, 5% cash)

A large proportion of the capital is invested in low-risk fixed income securities. The main objective of this allocation is to preserve the value of the initial capital. However, a portion of the allocation is invested in equities to take advantage of their higher returns in order to protect against inflation. - Dynamic portfolio: (25% bonds, 70% equities, 5% cash)

This is the opposite of a conservative strategy. With a composition geared towards equities, the aim of this portfolio is to benefit from their growth. Bonds are used to diversify the risk. This portfolio is likely to be much more volatile. - Balanced portfolio: (40% bonds, 55% equities, 5% cash)

This is the compromise between the two more extreme strategies. It involves taking advantage of the potential growth in equities, while maintaining a significant proportion of fixed income investments to reduce risk. The potential return is lower than with a dynamic strategy, but the risk is more controlled.

Monitoring and adjusting your portfolio

It is very likely that you will need to make adjustments to your investment portfolio depending on the performance of financial markets. For example, you may decide to buy or sell a given security or to adjust your asset allocation strategy. That's why each of these portfolios includes a cash component.

Sometimes it’s also necessary to make adjustments to maintain your original strategy. For example, if your equities outperform your bonds, you may need to increase the percentage of equities in your portfolio. To rebalance your portfolio, you will need to sell some shares or buy some bonds to maintain your desired weighting. This is called portfolio rebalancing.

A solution tailored to your profile

The above portfolios are only examples and can be adapted to suit your preferences. There is no ideal portfolio, only the one that best suits your profile and needs as an investor. Your strategy may be radically different depending on your age, wealth, interests, life plans or risk tolerance.

If you’re a young investor at the start of your career, you may choose a more dynamic strategy. In this case the longer time horizon will make it easier to achieve your goals. However, if you are approaching retirement and want to consolidate your assets, it may be advisable to adopt a more conservative approach. .

The composition of your portfolio may also be influenced by your personal interests or the time you wish to dedicate to working on it. You may have a particular interest in certain geographical regions or in industries that seem to offer promising growth potential. You could also take the time to pick your stocks one by one, based on your analysis and convictions, or you could choose to invest in various funds to simplify the selection process.

It's also entirely possible to ask experts for help, either through a discretionary mandate or an advisory mandate.

You can entrust Piguet Galland with a specific "distribution" management mandate to intelligently finance your cash needs, for example to supplement your income from work or from your pension. This solution is particularly suitable for investors who wish to maintain their lifestyle. The payout (or distribution) is based on the capital invested, to ensure a stable, predictable stream of income. You benefit from globally diversified income sources (bond coupons, dividends, option premiums) and certain tax advantages for Swiss residents. It’s important to note that this diversified, multi-asset portfolio is made up of financial products selected not only for their potential to generate income, but also for their resilience to help protect your capital.

If you would like to find out more about the ‘Distribution’ mandate, join us for our webinar on 7 May 2024, starting at 11am.

As you can see, there is no one-size-fits-all approach, only the one that best suits your profile. Our teams of experts will be happy to help you take the first steps in building your portfolio and investment strategy.

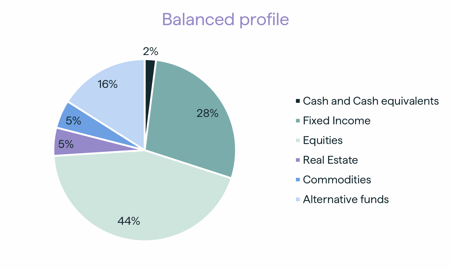

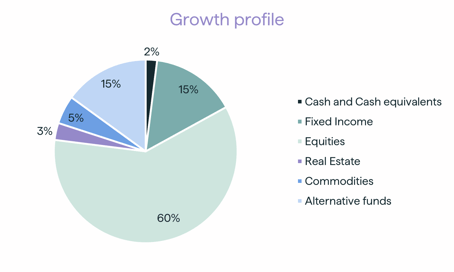

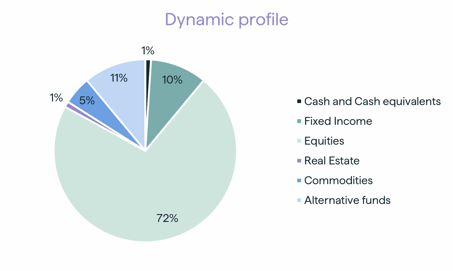

Allocations of 3 profiles in CHF