The 360 Series

Understanding the impact of early retirement or expatriation

Retiring a few years early or moving abroad to enjoy the sun... Discover how these choices can impact your financial situation.

Expatriation: What are the legal and tax implications?

Many Swiss retirees choose to move to sunnier destinations in search of a gentler lifestyle, a pleasant climate, and greater purchasing power. However, before packing your bags and leaving the country, it is essential to consider several important legal and financial aspects.

The bilateral agreements on the free movement of persons between the European Union and Switzerland state that Swiss nationals without gainful employment have the right to reside for at least five years in any EU or EFTA member state, provided they have sufficient financial means and adequate health insurance. The residence permit is automatically renewed as long as these conditions continue to be met.

Many countries outside the EU also grant residence permits to older immigrants who possess substantial assets.

To avoid delays in receiving your pension, it is important to notify both your pension fund and the OASI compensation office of your change of residence.

Retirees receiving only a Swiss pension are generally required to obtain health and accident insurance from a Swiss health insurer. You can find a list of insurers operating in various countries at www.priminfo.ch.

By considering these elements, you will be better prepared to plan your retirement abroad and fully enjoy this new stage of your life.

.png?width=832&height=416&name=Assurance%20maladie%20-%20EN%20(1).png)

In general, anyone who leaves Switzerland permanently becomes taxable abroad on all of their income and assets. However, businesses and real estate located in Switzerland, as well as the income they generate, remain subject to taxation in Switzerland. The income from these assets continue to be taxable in Switzerland.

The applicable tax rate is determined based on the taxpayer’s total worldwide income and wealth. If no income or wealth declaration is submitted abroad, the Federal Tax Administration may apply the maximum tax rate. This means that if you reside abroad and hold a securities portfolio in Switzerland, you will be subject to a 35% withholding tax on dividends and interest.

However, you may be able to recover all or part of this tax depending on the double taxation agreement between Switzerland and your country of residence. A full refund of the withholding tax can be requested if the country in which you reside has a double taxation agreement with Switzerland.

By taking these tax considerations into account, you will be better prepared to manage your financial situation once you leave Switzerland permanently.

Early retirement: how to prepare for it?

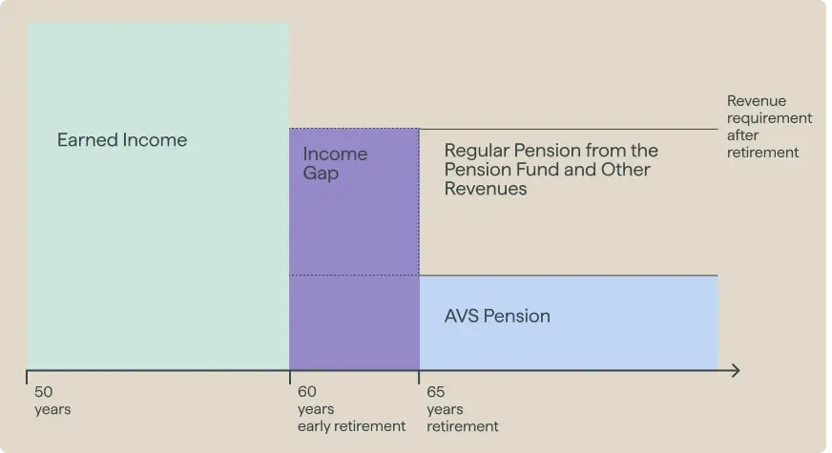

Whether by choice or circumstance, some people decide to retire early. With proper planning and enough time to prepare, early retirement can become an achievable goal, and even allow you to enjoy a very comfortable pre‑retirement lifestyle. The key is simply to prepare wisely.

A crucial first step is to bridge the pension gaps created by retiring early. Drawing your OASI benefits and pension fund assets earlier than usual can help, as can using bridging pensions or taking on supplementary part‑time work to ease the transition.

Most pension funds allow early withdrawal of retirement benefits from age 58 or 60. However, early withdrawals will result in a lower retirement capital than if you retired at the statutory age.

Some pension funds do offer the option to offset this reduction through voluntary buy‑ins.

Personal savings, such as Pillar 3a, savings accounts, liquid investments, or real estate, are often the best way to cover the income gap that arises with early retirement.

If you are considering early retirement, our experts are here to help you find the best solution for your goals.

Staggered retirement

Another alternative is staggered retirement, meaning gradually reducing your level of employment. Pension funds generally allow insured members to take early retirement benefits.

Since the introduction of Article 13a of the Occupational Pension Act in 2023, all pension funds are required to allow staggered retirement.

Article 13a – Withdrawal of part of the retirement benefit

-

The insured person can receive their retirement benefit in the form of an annuity in up to three stages, although your pension fund may allow more stages. A “stage” includes all capital withdrawals made within the same calendar year.

-

If the retirement benefit is taken as lump sum, the withdrawal may also be made in up to three stages. This rule applies even when the salary earned with a single employer is insured across multiple pension funds.

-

The first partial withdrawal must generally represent at least 20% of the retirement benefit, although your pension fund may allow a lower minimum percentage.

-

Mandatory full withdrawal in certain cases: if the remaining annual salary falls below the minimum amount required for coverage under the fund’s regulations, the pension fund may stipulate that the entire retirement benefit must be withdrawn.

Ready to plan your retirement?

You’ve now completed our 360 series dedicated to retirement. We hope it has provided you with all the information you need to prepare for this new chapter with confidence.

Our team of experts is here to support you and guide you through every step of this important stage in your life.

The "Retirement" series

Piguet Galland designed the 360 Series to provide you with the essential keys to bringing your projects to life. This series will provide you with all the information you need to enjoy a worry-free retirement.

-

Episode #1

Retirement: Preparing for the future with peace of mind

Get an overview of everything you need to know

-

Episode #2

Understanding Switzerland’s three‑pillar pension system

The state pension (OASI), the occupational pension, and the voluntary third pillar.

-

Episode #3

Pension or lump sum

Discover how to make the right choice depending on your situation and your long-term plans.

-

Episode #4

Tax and Mortgage

Identify the right strategy to support your retirement planning. -

Episode #5

Expatriation or early retirement: what's the impact?

Whether you’re considering a move abroad or thinking about retiring early, we provide all the guidance you need to make informed decisions.

A life project is not something you share with just anyone.

Dedicated experts in every field.

-

Investment

- Portfolio management

- Taxation

From investment advice to delegated portfolio management, we are dedicated to safeguarding your capital and securing its growth by identifying investment solutions that align seamlessly with your values, goals, and the assurance of peace of mind.

-

Wealth & Pension

advice- cohabitation or marriage

- Divorce

- Family

- Careers and pensions

- inheritance & succession

Bring vitality and success to your life projects by comprehensively analyzing your assets and optimizing their structure.

-

Financing

- Real estate projects

- Mortgage loan

- Lombard Loan

We offer various financing solutions for all your real estate projects, such as mortgages and Lombard loans.

Piguet Galland DNA

Your projects with complete peace of mind

To provide you with the best possible support, we want to understand what keeps you awake at night, your plans, and your dreams. Our expertise lies in aligning your assets with projects close to your heart.

Your trusted partner

We understand that you expect more from us than trust and expertise. Above all, you want peace of mind for both the future and the present. It's our responsibility to deliver.

French-speaking and close to you

Because we are close to you, where you need us, and available when you need us, we conduct our wealth management business with agility and efficiency and always with a smile.

A human-scale bank backed by a solid financial group

Our majority shareholder, Banque Cantonale Vaudoise, is one of the few major banks in the world without a state guarantee, and it holds an AA rating from Standard & Poor's. This is concrete proof of our results.