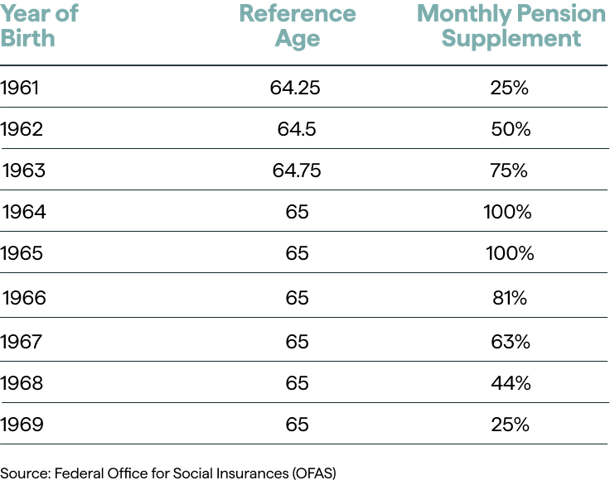

As a result, women born between 1961 and 1969 will receive lifelong pension supplements as a compensatory measure. The amount of these supplements will vary depending on the year of birth.

Changes may occur over time, but with proper preparation, you will be able to manage them and minimise their impact on your retirement plan. It is essential to carefully determine the date of your retirement, whether you are considering early retirement or planning to extend your career. Establish a budget that allows you to live comfortably and pursue your goals, while ensuring that your income will be sufficient to cover your expenses.

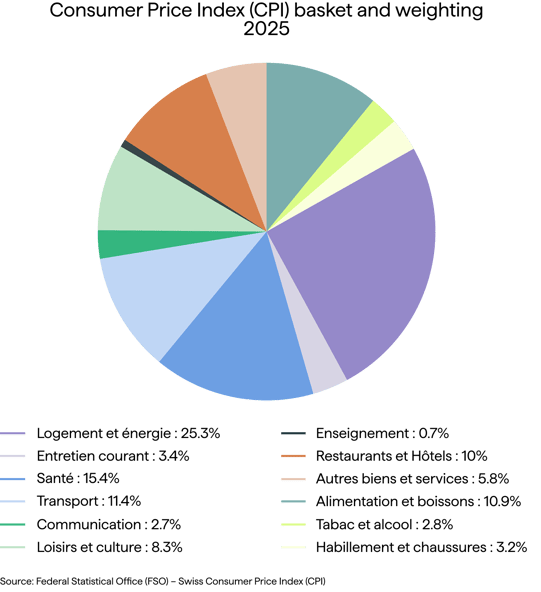

Don’t wait: open your Excel spreadsheet and list your monthly and annual expenses. This will give you a clear sense of your financial needs in retirement. Keep in mind that some work‑related costs, such as commuting and meal expenses, will disappear, and certain insurance premiums will decrease slightly. However, supplementary health insurance becomes more expensive as you age.

In the upcoming episodes, we will take a closer look at the various dimensions of retirement, including the state pension system, the choice between an annuity or a lump sum, tax implications, early retirement, mortgages, and expatriation.

For now, let’s begin by focusing on the key dates you need to prepare for your dolce vita.

Financial strategies by life stage

Ages 30 to 45: Build strong wealth early

Whether you are 30 or 45, it is important to establish a solid savings strategy to ensure long‑term financial security.

For example, in 2025, Caroline, age 35, living in Lausanne with a taxable annual income of CHF 70,000, can contribute up to CHF 7,258 to her Pillar 3a account. If she chooses to contribute only CHF 4,000, she will benefit from a tax saving of CHF 938 for the 2025 tax year. By continuing to contribute CHF 4,000 each year until age 65, she will have accumulated CHF 100,000 in savings and earned CHF 42,615 in interest at a rate of 2.5%.

Ages 50 to 55: Optimise your retirement strategy

As you approach your fifties, preparing for retirement becomes essential, as you have around fifteen years left to secure your financial position for the years ahead.

Five years before retirement: Make key decisions

As you approach the five‑year mark before retirement, this period becomes crucial for making the essential decisions that will ensure a smooth and well‑planned transition into the next stage of your life.