The 360 Series

Pension or lump sum?

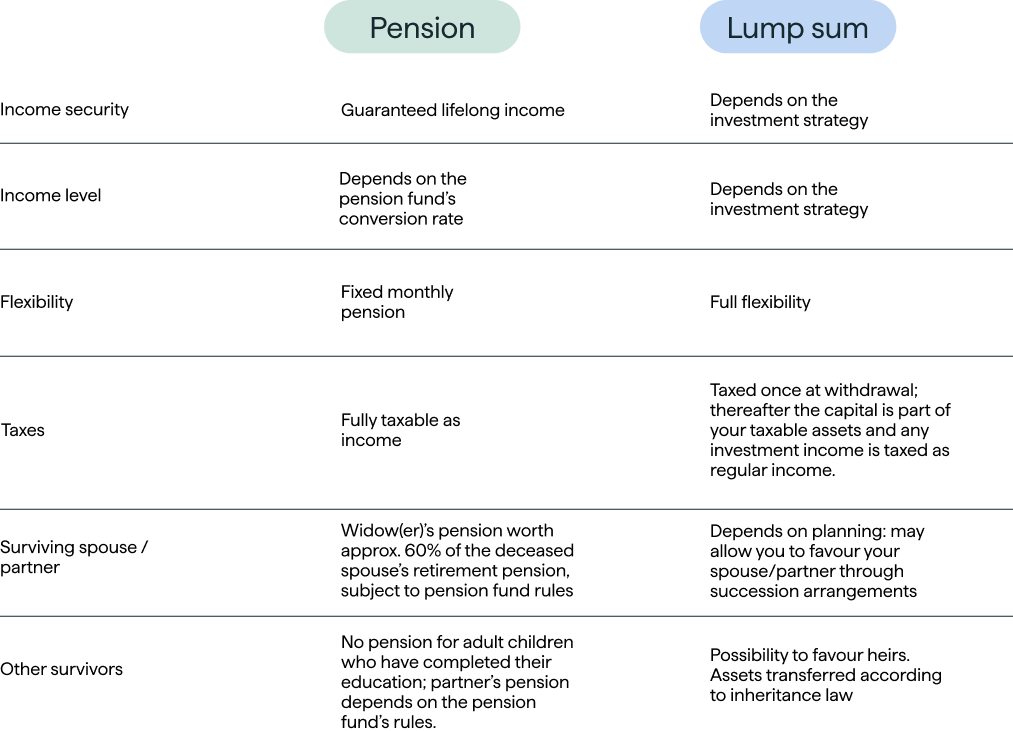

As you approach retirement, you must choose whether to receive your benefits as a lifelong pension or as a lump sum. This decision will impact your income, financial flexibility, tax burden, and the protection you provide for your loved ones.

Throughout your career, significant assets have accumulated in your pension fund. As you approach retirement, you must decide whether to receive these savings as a lifelong pension or as a lump sum, either in full or in part.

There is no right or wrong choice; this decision not only affects the amount and stability of your income, but also your financial flexibility, tax burden, and the financial security of your loved ones. Every situation is unique and depends on your personal goals.

Our dedicated wealth solutions team is here to guide you through this complex decision with personalised advice.

Pension

The pension option provides the security of a regular, lifelong income, freeing you from the responsibility of managing your accumulated assets. However, one important drawback is that this income is added to your OASI pension, increasing your total taxable income. In addition, your surviving spouse or partner will generally receive only 60% of your pension after your death.

Pension payments also do not guarantee stable purchasing power: with an annual inflation rate of 1.5% and no pension adjustment, a pension worth CHF 5,000 today could fall to the equivalent of CHF 4,300 in ten years and CHF 3,700 in twenty years. Moreover, if there is no surviving spouse or partner, the pension fund may keep the entire remaining capital, with no payments made to adult children (over age 18, or 25 if still in education).

Choosing a pension can nevertheless offer additional benefits, such as child pensions. If you are retired and have dependent children, you may receive a 20% supplement for each child until they complete their education, up to a maximum age of 25.

Lump Sum

If you choose to withdraw your capital, you have full freedom to use your pension assets as you wish and decide how much to withdraw based on your needs. In the first years of retirement, this may allow you to generate a higher income or take a larger withdrawal to reduce a mortgage, renovate your home, or provide an early inheritance.

However, those who opt for a lump sum withdrawal must then generate their own form of income from this capital. It is generally advisable to invest most of the withdrawn capital in securities to generate returns.

Taking the lump sum should not compromise your long‑term financial comfort. Investment returns alone cannot guarantee the preservation of your lifestyle. Viewed with this in mind, the lump‑sum option offers many advantages, provided the assets are managed carefully.

Mixed retirement

Many future retirees struggle to choose between a pension and a lump sum. As a result, more and more people are opting for a mixed solution: receiving part of their benefits as a lump sum while converting the remainder into a lifelong pension.

In this approach, the pension covers your essential needs for life, while the capital provides the liquidity you need for your projects. Today, the goal is often to find the right balance between pension and capital, combining the strengths of both models while diversifying risks.

Ready to plan your retirement?

The "Retirement" series

Piguet Galland designed the 360 Series to provide you with the essential keys to bringing your projects to life. This series will provide you with all the information you need to enjoy a worry-free retirement.

-

Episode #1

Retirement: Preparing for the future with peace of mind

Get an overview of everything you need to know

-

Episode #2

Understanding Switzerland’s three‑pillar pension system

The state pension (OASI), the occupational pension, and the voluntary third pillar.

-

Episode #3

Pension or lump sum

Discover how to make the right choice depending on your situation and your long-term plans.

-

Episode #4

Tax and Mortgage

Identify the right strategy to support your retirement planning. -

Episode #5

Expatriation or early retirement: what's the impact?

Whether you’re considering a move abroad or thinking about retiring early, we provide all the guidance you need to make informed decisions.

A life project is not something you share with just anyone.

Dedicated experts in every field.

-

Investment

- Portfolio management

- Taxation

From investment advice to delegated portfolio management, we are dedicated to safeguarding your capital and securing its growth by identifying investment solutions that align seamlessly with your values, goals, and the assurance of peace of mind.

-

Wealth & Pension

advice- cohabitation or marriage

- Divorce

- Family

- Careers and pensions

- inheritance & succession

Bring vitality and success to your life projects by comprehensively analyzing your assets and optimizing their structure.

-

Financing

- Real estate projects

- Mortgage loan

- Lombard Loan

We offer various financing solutions for all your real estate projects, such as mortgages and Lombard loans.

The Piguet Galland DNA

Your projects with complete peace of mind

To provide you with the best possible support, we want to understand what keeps you awake at night, your plans, and your dreams. Our expertise lies in aligning your assets with projects close to your heart.

Your trusted partner

We understand that you expect more from us than trust and expertise. Above all, you want peace of mind for both the future and the present. It's our responsibility to deliver.

French-speaking and close to you

Because we are close to you, where you need us, and available when you need us, we conduct our wealth management business with agility and efficiency and always with a smile.

A human-scale bank backed by a solid financial group

Our majority shareholder, Banque Cantonale Vaudoise, is one of the few major banks in the world without a state guarantee, and it holds an AA rating from Standard & Poor's. This is concrete proof of our results.