Asset management

Crafted to capitalise on growth trends, Piguet Galland funds and share certificates target sustained capital appreciation through a meticulous approach.

-

-

Piguet Fund - North American Equities

The Piguet Fund - North American Equities (USD) is a fund incorporated under Swiss law that primarily invests in North American equities. It also selectively invests in other funds. The fund offers daily liquidity.

Daniel Steck

Analyst Fund Manager

Piguet Fund - North American Equities

-

-

North America A Equities

-

-

Currency

USD

-

ISIN

CH0128045579

-

Distribution mode

Distribution

-

-

-

- Institutional Reserved

-

North America I Equities

-

-

Currency

USD

-

ISIN

CH0390987938

-

Distribution mode

Distribution

-

-

-

Piguet Fund - Asia- Equities ex-Japan

The Piguet Fund - Asia Equities ex-Japan (USD), incorporated under Swiss law, focuses on stock markets in the Pacific Basin, excluding Japan. It also selectively invests in other funds. The fund may utilize derivatives like futures, options, and convertibles. Daily liquidity is available.

Ed Yau

Analyst Fund Manager

Piguet Fund - Asia- Equities ex-Japan

-

-

Asia Equities ex-Japan A

-

-

Currency

USD

-

ISIN

CH0128045660

-

Distribution mode

Distribution

-

-

-

- Institutional Reserved

-

Asia Equities ex-Japan I

-

-

Currency

USD

-

ISIN

CH0390987953

-

Distribution mode

Distribution

-

-

-

Piguet Fund – Japan Equities

Piguet Fund - Japan Equities, a Swiss-registered fund, is primarily invested in Japanese equities and selectively in other funds. The use of derivatives, such as futures, options, and convertibles, is possible. The fund offers daily liquidity.

Ed Yau

Analyst Fund Manager

Piguet Fund – Japan Equities

-

-

Japan A Equities

-

-

Currency

JPY

-

ISIN

CH0128045645

-

Distribution mode

Distribution

-

-

-

- Institutional Reserved

-

Japan I Equities

-

-

Currency

JPY

-

ISIN

CH0390987946

-

Distribution mode

Distribution

-

-

-

Piguet Fund - Pan European Equities

The Piguet Fund - Actions Pan-Europe invests in European equities and selectively in other funds. It may utilise linked instruments such as options, warrants, and convertibles. The fund provides daily liquidity.

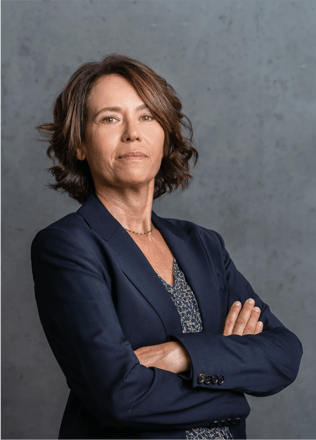

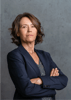

Christina Carlsten

Analyst Fund Manager

Piguet Fund - Pan European Equities

-

-

Pan-European Equities A

-

-

Currency

EUR

-

ISIN

CH0128045496

-

Distribution mode

Distribution

-

-

-

- Institutional Reserved

-

Pan-European Equities I

-

-

Currency

EUR

-

ISIN

CH0390987920

-

Distribution mode

Distribution

-

-

-

Piguet Fund - Swiss equities

The Piguet Fund - Swiss Equities aims for long-term capital growth by combining top-down analysis and bottom-up selection. The portfolio focuses on around twenty stocks, including SMI blue chips to small and mid-caps. Derivatives, third-party funds, and cash may be used to manage volatility and seize opportunities. The fund offers daily liquidity.

Daniel Steck

Analyst Fund Manager

Piguet Fund - Swiss equities

-

-

Swiss Equities A

-

-

Currency

CHF

-

ISIN

CH0104837494

-

Distribution mode

Distribution

-

-

-

- Institutional Reserved

-

Swiss Equities I

-

-

Currency

CHF

-

ISIN

CH0261293432

-

Distribution mode

Distribution

-

-

-

Piguet Fund - Swiss Equities SMID

The Piguet Fund - Swiss Equities SMID concentrates on the small and mid-cap segment of the Swiss stock market, offering diversification with active management. The portfolio includes innovative and dynamic Swiss companies. The manager may use third-party funds, derivatives, and cash for risk management or opportunity exploitation.

Daniel Steck

Analyst Fund Manager

Piguet Fund - Swiss Equities SMID

Swiss small and mid-cap equity fund.

-

-

Piguet Fund Swiss Equities - SMID A

-

-

Currency

CHF

-

ISIN

CH1148776656

-

Distribution mode

Distribution

-

-

-

- Institutional Reserved

-

Piguet Fund Swiss Equities - SMID I

-

-

Currency

CHF

-

ISIN

CH1148776664

-

Distribution mode

Distribution

-

-

-

Piguet Fund - Pondéré

The Piguet Fund - Weighted, a Swiss-incorporated fund, invests in short-term investments, bonds, and equities worldwide, following Piguet Galland's medium-risk investment strategy. It may utilise instruments like options, warrants, convertibles, and investment funds. The fund is available in CHF, EUR, and USD, with weekly liquidity.

Claudia Dorsaz

Analyst Fund Manager

Piguet Fund - Pondéré

-

-

Weighted (CHF) A

-

-

Currency

CHF

-

ISIN

CH0104837502

-

Distribution mode

Distribution

-

-

-

-

Weighted (EUR) A

-

-

Currency

EUR

-

ISIN

CH0104837510

-

Distribution mode

Distribution

-

-

-

-

Weighted (USD) A

-

-

Currency

USD

-

ISIN

CH0128491880

-

Distribution mode

Distribution

-

-

-

-

Piguet Global Fund - International bond

The Piguet Global Fund - International Bond is a Luxembourg mutual fund aiming for high returns while preserving capital. It invests in international bond markets, including convertible bonds and bonds with options. The fund is available in CHF, EUR, and USD, offering daily liquidity.

Daniel Varela

Chief Investment Officer

Piguet Global Fund - International bond

-

-

International Bond (CHF) C

-

-

Currency

CHF

-

ISIN

LU0079235031

-

Distribution mode

Capitalization

-

-

-

-

International Bond (CHF) D

-

-

Currency

CHF

-

ISIN

LU0079234737

-

Distribution mode

Distribution

-

-

-

- Institutional Reserved

-

International Bond (CHF) I

-

-

Currency

CHF

-

ISIN

LU0493469307

-

Distribution mode

Capitalization

-

-

- Institutional Reserved

-

International Bond (CHF) J

-

-

Currency

CHF

-

ISIN

LU0493469729

-

Distribution mode

Distribution

-

-

-

International Bond (EUR) C

-

-

Currency

EUR

-

ISIN

LU0079235973

-

Distribution mode

Capitalization

-

-

-

-

International Bond (EUR) D

-

-

Currency

EUR

-

ISIN

LU0079235627

-

Distribution mode

Distribution

-

-

-

- Institutional Reserved

-

International Bond (EUR) I

-

-

Currency

EUR

-

ISIN

LU0493470651

-

Distribution mode

Capitalization

-

-

- Institutional Reserved

-

International Bond (EUR) J

-

-

Currency

EUR

-

ISIN

LU0493470909

-

Distribution mode

Distribution

-

-

-

International Bond (USD) C

-

-

Currency

USD

-

ISIN

LU0079235460

-

Distribution mode

Capitalization

-

-

-

-

International Bond (USD) D

-

-

Currency

USD

-

ISIN

LU0079235114

-

Distribution mode

Distribution

-

-

-

- Institutional Reserved

-

International Bond (USD) I

-

-

Currency

USD

-

ISIN

LU0493470065

-

Distribution mode

Capitalization

-

-

- Institutional Reserved

-

International Bond (USD) J

-

-

Currency

USD

-

ISIN

LU0493470495

-

Distribution mode

Distribution

-

-

-

Piguet International Fund - World equities

The Piguet International Fund - World Equities is a Luxembourg SICAV governed by Luxembourg law. It aims to invest mainly in carefully selected funds across various markets based on the bank's investment strategy. The fund's liquidity is available every week.

Christina Carlsten

Analyst Fund Manager

Piguet International Fund - World equities

-

-

World Equities D (CHF)

-

-

Currency

CHF

-

ISIN

LU0479867532

-

Distribution mode

Distribution

-

-

-

-

World Equities D (EUR)

-

-

Currency

EUR

-

ISIN

LU0334117230

-

Distribution mode

Distribution

-

-

-

-

World Equities D (USD)

-

-

Currency

USD

-

ISIN

LU0234577681

-

Distribution mode

Distribution

-

-

-

-

Piguet Strategies - Piguet Opportunity Fund

The Piguet Opportunité Fund is a fund of funds that comprises various alternative strategies. Its goal is to outperform 6-month money market deposits with limited volatility. It primarily invests in "Long/Short" equities, "Long/Short" bonds, "Event-Driven," and "Multi-Strategy" strategies to seize identified opportunities.

Léonard Dorsaz

Analyst Fund Manager

Piguet Strategies - Piguet Opportunity Fund

-

- Reserved for Institutional and Professional Investors

-

Piguet Opportunity Fund C CHF

-

-

Currency

CHF

-

ISIN

LU0721785995

-

Distribution mode

Capitalization

-

-

- Reserved for Institutional and Professional Investors

-

Piguet Opportunity Fund C EUR

-

-

Currency

EUR

-

ISIN

LU0721785722

-

Distribution mode

Capitalization

-

-

- Reserved for Institutional and Professional Investors

-

Piguet Opportunity Fund C USD

-

-

Currency

USD

-

ISIN

LU0084093235

-

Distribution mode

Capitalization

-

-

-

Piguet pension strategies - Piguet Active Pension 25

The Piguet Active Prévoyance 25 is a multi-asset class fund that complies with the standards of legislation on old-age, survivors', and disability pension provision (OPP 2). The compartment is authorised to invest in stocks of companies worldwide (up to 35%), international bonds up to 100%, and real estate up to 15%. The compartment is also authorised to invest in alternative classes (hedge funds & commodities) up to 15%. Cash is allowed up to 25%, and exposure to foreign currencies cannot exceed 30%.

Vincent Heyberger

Institutional Portfolio Manager

Piguet pension strategies - Piguet Active Pension 25

-

-

Piguet Active Pension 25 CHF A

-

-

Currency

CHF

-

ISIN

CH1233586721

-

Distribution mode

Distribution

-

-

-

- Reserved for investors as defined in Art. 38a para. 1 OIA

-

Piguet Active Pension 25 CHF P

-

-

Currency

CHF

-

ISIN

CH1233586747

-

Distribution mode

Capitalization

-

-

-

Piguet pension strategies - Piguet Active Pension 40

The Piguet Active Prévoyance 40 is a multi-asset class fund that complies with the standards of legislation on old-age, survivors', and disability pension provision (OPP 2). The compartment is authorised to invest in stocks of companies worldwide (up to 50%), international bonds up to 100%, and real estate up to 15%. The compartment is also authorised to invest in alternative classes (hedge funds & commodities) up to 15%. Cash is allowed up to 25%, and exposure to foreign currencies cannot exceed 30%.

Vincent Heyberger

Institutional Portfolio Manager

Piguet pension strategies - Piguet Active Pension 40

-

-

Piguet Active Pension 40 CHF A

-

-

Currency

CHF

-

ISIN

CH1233586754

-

Distribution mode

Distribution

-

-

-

- Reserved for investors as defined in Art. 38a para. 1 OIA

-

Piguet Active Pension 40 CHF P

-

-

Currency

CHF

-

ISIN

CH1233586770

-

Distribution mode

Capitalization

-

-

-

Piguet Global Fund - International bond Institutionnals

The Piguet Global Fund - International Bond is a Luxembourg mutual fund aiming for high returns while preserving capital. It invests in international bond markets, including convertible bonds and bonds with options. The fund is available in CHF, EUR, and USD, offering daily liquidity.

Daniel Varela

Chief Investment Officer

Piguet Global Fund - International bond Institutionnals

-

- Institutional Reserved

-

International Bond (CHF) I

-

-

Currency

CHF

-

ISIN

LU0493469307

-

Distribution mode

Capitalization

-

-

- Institutional Reserved

-

International Bond (CHF) J

-

-

Currency

CHF

-

ISIN

LU0493469729

-

Distribution mode

Distribution

-

-

- Institutional Reserved

-

International Bond (EUR) I

-

-

Currency

EUR

-

ISIN

LU0493470651

-

Distribution mode

Capitalization

-

-

- Institutional Reserved

-

International Bond (EUR) J

-

-

Currency

EUR

-

ISIN

LU0493470909

-

Distribution mode

Distribution

-

-

- Institutional Reserved

-

International Bond (USD) I

-

-

Currency

USD

-

ISIN

LU0493470065

-

Distribution mode

Capitalization

-

-

- Institutional Reserved

-

International Bond (USD) J

-

-

Currency

USD

-

ISIN

LU0493470495

-

Distribution mode

Distribution

-

-

-

Piguet Fund - Swiss Equities SMID Institutionnals

The Piguet Fund - Swiss Equities SMID concentrates on the small and mid-cap segment of the Swiss stock market, offering diversification with active management. The portfolio includes innovative and dynamic Swiss companies. The manager may use third-party funds, derivatives, and cash for risk management or opportunity exploitation.

Daniel Steck

Analyst Fund Manager

Piguet Fund - Swiss Equities SMID Institutionnals

Swiss small and mid-cap equity fund.

-

- Institutional Reserved

-

Piguet Fund Swiss Equities - SMID I

-

-

Currency

CHF

-

ISIN

CH1148776664

-

Distribution mode

Distribution

-

-

-

-

Helv-Ethic

More and more investors recognise the value of a company's social responsibility criteria. It is, therefore, essential to present them with a quality offering that incorporates ethical thinking in the Swiss market.

Daniel Steck

Analyst Fund Manager

Helv-Ethic

Investing in Switzerland while being socially responsible.-

-

Helv-Ethic

-

-

Currency

CHF

-

ISIN

CH0370025428

-

Category

Responsible investment ,

-

-

-

-

Disruptive Healthcare

Living longer and, above all, living better is a major concern for an ever-growing population – those over the age of 65. This improved quality of life comes at a staggering cost to governments. At the same time, traditional pharmaceutical groups struggle to launch new drugs. This certificate offers exposure to the most innovative companies in the health sector.

Daniel Steck

Analyst Fund Manager

Disruptive Healthcare

Participating in the growth of the innovative medicine sector

-

-

Disruptive Healthcare

-

-

Currency

USD

-

ISIN

CH0436981986

-

Category

Innovation ,

-

-

-

-

Smart AI

Artificial intelligence (AI) is poised to revolutionise entire sectors of the economy by optimising efficiency, reducing costs and opening up new opportunities for growth. By harnessing massive data and advanced algorithms, AI enables faster and more accurate decisions, transforming traditional business models and offering significant innovation potential for companies ready to invest.

Daniel Steck

Analyst Fund Manager

Smart AI

Taking part in the technological revolution linked to Artificial Intelligence

-

-

Smart AI

-

-

Currency

USD

-

ISIN

CH0359281273

-

Category

Digitalization , Innovation ,

-

-

-

-

Smart Cities

The Smart City concept is gaining momentum due to demographic growth, the challenges posed by climate change, and the growing interest in environmentally and socially responsible investment solutions. The Certificate invests in the shares of companies whose strategic focus is on developing products, technologies, or services linked to Smart Cities.

Christina Carlsten

Analyst Fund Manager

Smart Cities

Participating in the growth of smart cities

-

-

Smart Cities

-

-

Currency

EUR

-

ISIN

CH0398465085

-

Category

Demography , Environment , Digitalization ,

-

-

-

-

Women Empowerment

Women are a key driver of economic growth and corporate profitability. Various academic studies show that greater inclusion of women in the economy should lead to considerable gains. This certificate aims to capitalise on this dynamic and the resulting investment opportunities.

Christina Carlsten

Analyst Fund Manager

Women Empowerment

Promoting the full potential of women in the economy.

-

-

Women Empowerment

-

-

Currency

USD

-

ISIN

CH0519640715

-

Category

Demography , Responsible investment ,

-

-

-

-

Climate Action

Responsible investment to mitigate climate change. Climate change will eventually have irreversible repercussions on the planet. The stakes are high, and we all must play our part in preventing environmental disasters for future generations. The "Climate Action" certificate is an investment offer for investors sensitive to the responsibility of protecting the environment while actively capturing the investment opportunities created by this structural theme.

Ed Yau

Analyst Fund Manager

Climate Action

Contribute to the fight against global warming.

-

-

Climate Action

-

-

Currency

USD

-

ISIN

CH0478658369

-

Category

Environment , Responsible investment ,

-

-

-

-

Asian Prosperity

A certificate designed to capitalise on the growing purchasing power of Asian households. The OECD predicts sustainable long-term growth on the Asian continent and a 5% rise in the "petite bourgeoisie."

Ed Yau

Analyst Fund Manager

Asian Prosperity

Participating in the growth of the Asian middle class

-

-

Asian Prosperity

-

-

Currency

USD

-

ISIN

CH0383110886

-

Category

Demography ,

-

-

-

-

Emerging Markets Best Opportunities

While it's easy to see emerging markets as a demographic powerhouse for the decades to come, considering them as a homogenous region is undoubtedly an oversimplification. The disparity in economic maturity, combined with the potential for digitisation of the various countries' economies, represents some of the most attractive opportunities in emerging markets.

Ed Yau

Analyst Fund Manager

Emerging Markets Best Opportunities

Seizing the investment opportunities offered by the digitalisation of emerging economies

-

-

Emerging Markets Best Opportunities

-

-

Currency

USD

-

ISIN

CH0255766054

-

Category

Digitalization ,

-

-

-

-

Piguet Galland Mega-trends CHF

The popularity of thematic management continues to grow. Far removed from traditional management methods yet complementary, thematic management provides exposure to the long-term trends that characterise society in perpetual evolution. Combining our favourite themes in a single basket is an attractive solution for investors exploring this approach. Our team of analysts managing the Mega Trends portfolio can provide more information.

Ed Yau

Analyst Fund Manager

Piguet Galland Mega-trends CHF

A summary of our strongest thematic convictions

-

-

Piguet Galland Mega Trends CHF

-

-

Currency

CHF

-

ISIN

CH0545434042

-

Category

-

-

-

This site contains information relating to a large number of investment funds registered and managed in different jurisdictions. The information on this website is not directed to any person in any jurisdiction where (because of that person's nationality, residence or otherwise) the distribution of or access to this website is prohibited. Persons subject to such local restrictions must not access this website. The information published on this site constitutes neither a solicitation nor an offer nor a recommendation to buy or sell or to engage in any other transaction in investment instruments. More information

Contact an advisor

Reach out to one of our experts now to obtain detailed and personalized information, and give your capital the direction it deserves.