Institutional funds

An overview of our institutional funds.

Our institutional funds

Our offer reserved for institutional clients includes several funds managed by Piguet Galland.

-

Piguet Fund - Swiss Equities SMID Institutionnals

The Piguet Fund - Swiss Equities SMID concentrates on the small and mid-cap segment of the Swiss stock market, offering diversification with active management. The portfolio includes innovative and dynamic Swiss companies. The manager may use third-party funds, derivatives, and cash for risk management or opportunity exploitation.

Daniel Steck

Analyst Fund Manager

Piguet Fund - Swiss Equities SMID Institutionnals

Swiss small and mid-cap equity fund.

-

- Institutional Reserved

-

Piguet Fund Swiss Equities - SMID I

-

-

Currency

CHF

-

ISIN

CH1148776664

-

Distribution mode

name_enDistribution ,

-

-

-

Piguet Global Fund - International bond Institutionnals

The Piguet Global Fund - International Bond is a Luxembourg mutual fund aiming for high returns while preserving capital. It invests in international bond markets, including convertible bonds and bonds with options. The fund is available in CHF, EUR, and USD, offering daily liquidity.

Daniel Varela

Chief Investment Officer

Piguet Global Fund - International bond Institutionnals

-

- Institutional Reserved

-

International Bond (CHF) I

-

-

Currency

CHF

-

ISIN

LU0493469307

-

Distribution mode

name_enCapitalization ,

-

-

- Institutional Reserved

-

International Bond (CHF) J

-

-

Currency

CHF

-

ISIN

LU0493469729

-

Distribution mode

name_enDistribution ,

-

-

- Institutional Reserved

-

International Bond (EUR) I

-

-

Currency

EUR

-

ISIN

LU0493470651

-

Distribution mode

name_enCapitalization ,

-

-

- Institutional Reserved

-

International Bond (EUR) J

-

-

Currency

EUR

-

ISIN

LU0493470909

-

Distribution mode

name_enDistribution ,

-

-

- Institutional Reserved

-

International Bond (USD) I

-

-

Currency

USD

-

ISIN

LU0493470065

-

Distribution mode

name_enCapitalization ,

-

-

- Institutional Reserved

-

International Bond (USD) J

-

-

Currency

USD

-

ISIN

LU0493470495

-

Distribution mode

name_enDistribution ,

-

-

Delegate your investment management

We provide institutional clients with asset servicing solutions and diversified investment strategies supported by the expert advice of our teams.

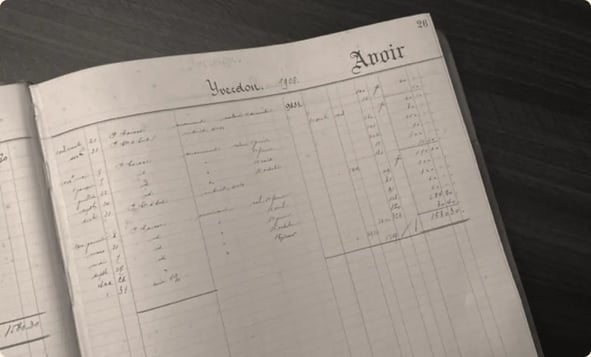

A solid heritage

Firmly established in French-speaking Switzerland since 1856, we are a private bank specialising in global wealth management. If we had to define our business model in one word, it would be proximity. Our comprehensive offering also enables us to serve institutional clients.

.webp?width=630&height=357&name=Rectangle%20144%20(1).webp)

A human scale Bank backed by a solid financial group

Our majority shareholder, Banque Cantonale Vaudoise, holds an AA rating from Standard & Poor's, a rare distinction among major banks worldwide. This 'A+A' rating is a testament to our consistent results.

Our team at your service

We are home to an institutional team with several leading names in the Swiss institutional market. Our recognised and experienced team will be able to optimise your investments according to your investment objectives. Our differentiation is based on solid pillars: performance, stability, experience and independence.

-

Stability

Our managers have been with us for 12 years. This stability enables us to forge solid relationships and better understand our customers' specific needs. By working with us, you'll benefit from our expert skills and the continual reassurance of a team here to support you in the long run!

-

Experience

Our team has an average of 25 years experience in asset management. This longevity is a testament to our commitment to excellence and ability to navigate market fluctuations successfully. The expertise we have built up over the years enables us to provide our clients with sound advice and proven strategies for achieving their financial goals.

-

Independence

Our asset management independence means we focus entirely on our clients' interests. Being free from any conflict of interest, we can select and recommend the solutions best suited to your financial needs without outside influence. This guarantees a personalised and transparent approach.

-

-

-

-

-

Daniel Varela holds a degree in business administration with a specialisation in finance from the University of Geneva and began his career in 1989 as a fixed income manager. He joined Banque Piguet & Cie in 1999 as head of institutional asset management and with responsibility for bond analysis and management. In 2011, he became head of the investment strategy and Piguet Galland's investment department. In 2012, he joined Piguet Galland's Executive Committee as CIO.

Read moreClose

-

-

-

-

-

-

-

Christophe Julen has over 20 years of experience in institutional asset management. He started his career as an auditor for banks and pension funds before working for more than 15 years with firms specializing in institutional asset management. He holds an MBA from INSEAD.

Read moreClose -

-

-

Daniel Varela holds a degree in business administration with a specialisation in finance from the University of Geneva and began his career in 1989 as a fixed income manager. He joined Banque Piguet & Cie in 1999 as head of institutional asset management and with responsibility for bond analysis and management. In 2011, he became head of the investment strategy and Piguet Galland's investment department. In 2012, he joined Piguet Galland's Executive Committee as CIO.

Read moreClose -

Christophe Julen has over 20 years of experience in institutional asset management. He started his career as an auditor for banks and pension funds before working for more than 15 years with firms specializing in institutional asset management. He holds an MBA from INSEAD.

Read moreClose

Legal information

- This site contains information relating to a large number of investment funds registered and managed in different jurisdictions. The information on this website is not directed to any person in any jurisdiction where (by reason of that person's nationality, residence or otherwise) the distribution of or access to this website is prohibited. Persons subject to such local restrictions must not access this website. The information published on this website does not constitute a solicitation or an offer or a recommendation to buy or sell or to enter into any other transaction in investment instruments. Further information

%20(1).webp?width=330&height=150&name=Group%20678%20(1)%20(1).webp)

.webp?width=330&height=150&name=Group%20685%20(1).webp)

.webp?width=330&height=150&name=Group%20686%20(1).webp)