US government shutdown: what are the impacts?

Since last Wednesday, the United States has been experiencing a government shutdown. In other words, the salaries of all federal employees in non-essential roles have been frozen, and those employees have been placed on furlough. The root cause lies in a budgetary standoff between Republicans and Democrats, which is currently preventing an agreement on raising the country’s debt ceiling.

This highly unpopular situation is expected to have several adverse consequences. First, on the economy: the estimated negative impact on GDP is around 0.2% per week of shutdown. Second, on the release of key economic data, such as unemployment figures, which could not be published last Friday. These statistics are nonetheless essential, particularly for the Federal Reserve, which relies on them to guide its monetary policy decisions.

For now, the markets do not appear concerned by this political deadlock, likely betting on swift negotiations and a resolution before the end of the week.

European equities: on the path to new highs

After trading sideways since spring, European stock markets broke decisively higher last week, setting a new all-time record, buoyed by sustained buying flows. This breakout reinforces our positive stance, underpinned by surprisingly resilient fundamentals across the euro area.

For several months, macroeconomic surprises have remained in favourable territory, and leading indicators now point to a gradual recovery in activity. Admittedly, investors remain attentive to geopolitical and political uncertainties, particularly in France, where the resignation of Sébastien Lecornu has once again left the country awaiting a new government. While political risk remains an inherent feature of the European landscape, it does not, in our view, undermine the overall positive medium-term outlook.

Stimulus measures, such as infrastructure and defense investments in Germany, add to a still-accommodative monetary policy and a potential rebound in activity. Collectively, these elements offer durable support for the continent’s outlook.

Meanwhile, the 15% tariffs imposed by the United States remain manageable and far less punitive than for other regions and therefore should not derail the current momentum. As for the strength of the euro, it does represent a headwind, but the European Central Bank still has room to maneuver.

In this environment, European equities should remain well supported. Their valuations, near the 30-year historical average, appear significantly more attractive than those of the US market. The ongoing decline in inflation supports multiple expansion, while corporate earnings are expected to recover as early as next year. Finally, recent capital inflows and the still-low allocation to European equities in global portfolios suggest that considerable upside potential remains.

This week’s figure: 100'000 CHF/kg

Gold closed the week at a new historical high in both Swiss francs and US dollars. Expectations of interest rate cuts in the United States have been the catalyst for the current upward trend. While we remain positive on gold over the medium term, a partial profit-taking appears prudent given the speed of the recent rally.

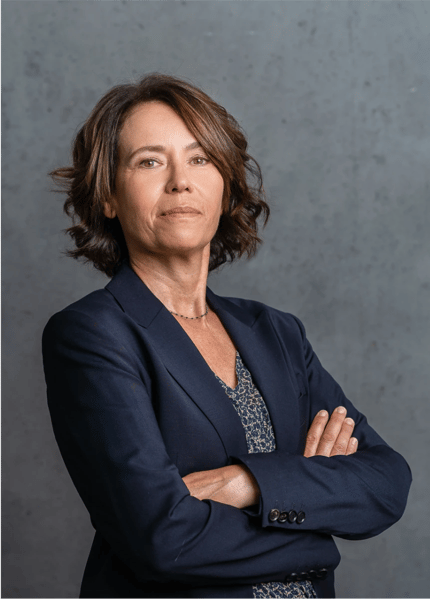

Author

-

Holder of a degree in Economics from Lund University in Sweden, Christina Carlsten is a Senior Analyst and Portfolio Manager for European markets at Piguet Galland, which she joined in 1997. She began her career at Banque Scandinave in Switzerland in private banking before specialising in financial analysis and fund management. Within the Bank, she now oversees the management of funds and thematic certificates invested in European and global equities.

.png?width=488&height=440&name=Rectangle%2034624651%20(1).png)

-1.png?width=488&height=440&name=Group%20316127847%20(4)-1.png)