Our Corporate Social Responsibility

We consider the social and environmental impact of all our decisions to contribute to a fairer and more humane world.

Private Bank

Resources

Discover us

Durability

Our Responsible Investment Policy defines our strategic approach to embedding environmental, social, and governance (ESG) criteria into our investment processes. It provides a comprehensive overview of our methodologies for ESG analysis, exclusion strategies, and practical implementation measures.

In terms of investment, the fundamental principles of our SRI approach combine three elements: transparency, measurability and materiality. These are reflected in the various investment solutions we offer our customers to meet their sustainability needs and sensitivities.

In addition to our market analysis and the underlying trends, we apply extra financial criteria to create a sustainable investment ecosystem.

Exclude controversial activities

Exclude companies that generate a significant proportion of their sales from controversial activities.

Investment in targeted thematics

Invest in sustainable development through our thematic certificates.

The concept of dual materiality

Promote investments that make a positive contribution to the environment and society.

As part of the dual materiality concept, the ESG Conviction profile enables you to generate environmental and social impact while taking ESG risks into account.

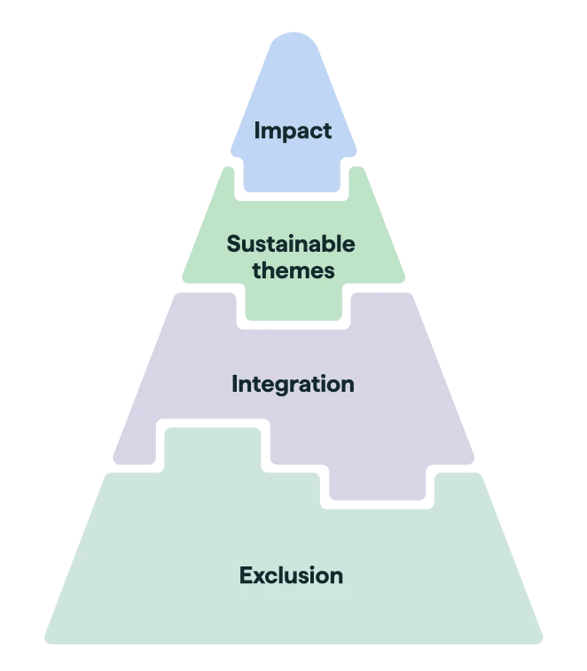

Responsible and sustainable management can be depicted as a pyramid, with the base representing the most restrictive sustainability criteria and the least restrictive apex. This model ranges from excluding investments in companies operating within controversial sectors to actively investing in businesses demonstrating a positive environmental, social, and governance (ESG) impact. At Piguet Galland, we adhere to an exclusion policy across all our funds, ensuring we do not support industries that conflict with our sustainability values. Additionally, we offer thematic equity certificates selected based on their potential for positive impacts, aligning with rigorous ESG criteria.

Year after year, we have developed several thematic equity certificates based on structural trends and sustainable themes such as climate change, gender equality, and corporate governance. By investing in these certificates, you can align your portfolio with your values and actively contribute to the issues that matter to you.

We consider the social and environmental impact of all our decisions to contribute to a fairer and more humane world.

Since 1856, we've been helping you plan for the future and enjoy the present with complete peace of mind.

We have developed a solid and balanced investment approach over time to provide you with a strategy aligned with your investor profile.

A conviction-based strategy focused on the long-term

Our investment approach is grounded in active management, informed by well-defined strategic directions and deeply held convictions, all of which have been shaped by our extensive experience. By constructing a robust portfolio focusing on long-term profitability, we position ourselves to successfully manage through periods of market volatility and take advantage of opportunities with a longer horizon.

Responsible investment

Environmental, social, and governance (ESG) responsibility is a critical concern that holds a central position in our decision-making process. Piguet Galland is proud to be a member of Swiss Sustainable Finance, advocating for integrating sustainability principles within Switzerland’s financial sector.

A good understanding and control of risks

Each of our investment decisions is preceded by an in-depth risk analysis. Our primary focus is the long-term preservation of your assets, ensuring that returns align with your investment profile. By collaborating closely with you, we gain a clear understanding of your specific goals and preferences, which allows us to tailor the optimal investment strategy for you.

From investment advice to delegated portfolio management, we are dedicated to safeguarding your capital and securing its growth by identifying investment solutions that align seamlessly with your values, goals, and the assurance of peace of mind.

Bring vitality and success to your life projects by comprehensively analyzing your assets and optimizing their structure.

We offer various financing solutions for all your real estate projects, such as mortgages and Lombard loans.