![]()

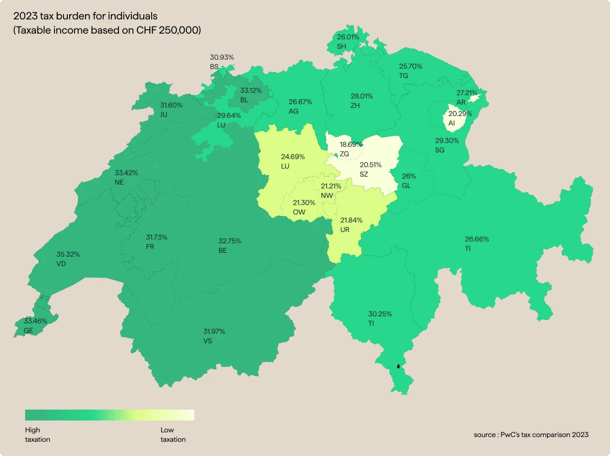

Due to the country's federal structure, the Swiss tax system is complicated and unique. Each canton and municipality has its tax system, particularly regarding tax rates and deductions. In order to have common rules, the tax authorities are subject to certain provisions such as the LIFD (federal law on direct taxes) or LHID (law on the harmonisation of direct taxes).

Income tax is collected at a federal, cantonal, and municipal level. Taxable income generally includes salaries, rental income, interest, and other sources of income. Swiss taxpayers must declare all their income and deductions by the due date: such as pension contributions, transport costs and health insurance, to determine their taxable income.

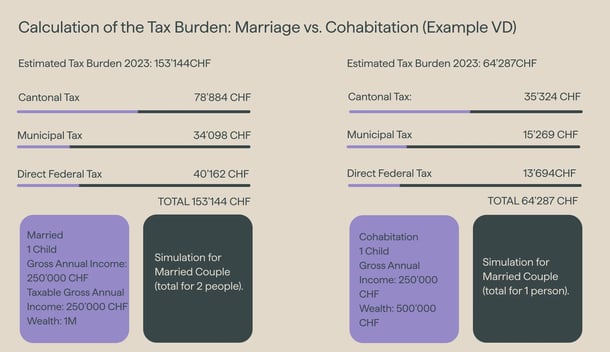

In Switzerland, married couples are generally taxed jointly, while cohabitees are taxed individually. For spouses, both incomes are added together, whereas cohabitees are taxed on their own income only. This difference in tax treatment can significantly impact the tax burden of married people, particularly when the couple's income is unevenly distributed. Therefore, it's essential to understand the tax differences between marriage and cohabitation when planning your finances (you can follow our webinar on this topic, available only in French).

The cantons and communes also collectwealth tax. It is calculated based on taxable assets, i.e., all securities (savings, securities, etc.) and real estate (principal residence, investment property, etc.) after deducting debts.

All securities that are held abroad must also be declared. Under international tax rules, the insured person's country of residence is responsible for taxing all securities the taxpayer holds in Switzerland or abroad. The same does not apply to real estate, as the country in which the property is located is responsible for taxing it. The Swiss tax authorities will nevertheless take into account these foreign-source items of real estate income and wealth by adding them to the items taxable in Switzerland, which helps to increase the tax rate (rate applied only to taxable items made/situated in Switzerland). Double taxation agreements exist to prevent the same item from being taxed twice.

In a country as tax-diverse as Switzerland, an in-depth understanding of cantonal tax regimes and tax optimisation strategies is essential for taxpayers.

Piguet Galland offers a complementary wealth assessment to evaluate your situation and analyse how you can optimise your tax situation.